2020 Spring Members’ Meeting Summary

Zell/Lurie Real Estate Center 2020 Spring Members’ Meeting

Held as a Zoom Webinar

Wednesday, April 29, 2020 – Thursday, April 30, 2020

The Spring 2020 Members’ Meeting began Wednesday evening, April 29, with a presentation by Bob Sulentic, President and Chief Executive Officer, CBRE. Sulentic spoke about his experience in various sectors and how the pandemic has affected each.

The following morning, the meeting made history as the first-ever presented virtually. Due to the Coronavirus pandemic, the panelists appeared via Zoom and spoke to an audience of more than 400, who joined in online from around the country and around the world.

Matthew J. Lustig, Chairman of Investment Banking, North America; Head of Real Estate & Lodging, Lazard; Chair, Advisory Board, Zell/Lurie Real Estate Center at the Wharton School, welcomed participants by acknowledging the virtual nature of the conference, calling this era a “time of profound import.” He noted that the day’s panels were comprised of “all stars,” including members of “Penn’s brilliant faculty who will help us navigate this shock.”

He then introduced Joe Gyourko, Nancy A. Nasher and David J. Haemisegger Director, Zell/Lurie Real Estate Center at the Wharton School, who talked about the efforts being taken by the Center to help students find employment; more than 25 MBAs and some undergraduate students are looking for jobs. He asked members to contact the Center if they need specific tasks performed. Gyourko also announced that 42 student award winners have been announced and the annual award book was sent to all members.

The day’s first panel, Wharton Faculty on the Markets, was moderated by Maisy Wong, James T. Riady Associate Professor of Real Estate; Assistant Director, Grayken Program in International Real Estate, Zell/Lurie Real Estate Center at the Wharton School. The panelists were Joe Gyourko, Peter Linneman, Sussman Professor Emeritus of Real Estate, the Wharton School, and Susan Wachter, Albert Sussman Professor of Real Estate and Professor of Finance, the Wharton School.

Wong introduced the panel noting that there was a lot to discuss, even though “we are in the early innings of the crisis. Let’s look at the economy broadly, then take a deeper dive into global and domestic real estate markets.”

“There were 165 million people in the labor force in February, and there were 30 million jobless claims as of today,” said Gyourko. “That’s 18 percent, and it will go higher. These are Great Depression numbers, and it will be a long slog out.”

He spoke about the lack of a V-shaped recovery because spending will continue to be down—in travel and restaurants, for example. “Structural unemployment will develop, in which about 1/4 of the labor force won’t see their jobs come back, which will damage the GDP and dampen spending,” he said, adding that he predicts a “synchronized global slowdown.” The damage has been great, especially to small businesses that are fragile, and even though the policy response has been “quick and powerful,” it will take time to get out.

Peter Linneman called the year-over-year numbers “irrelevant,” and suggested it was better to compare the numbers from the end of February to the end of March, and when that is done, the country is currently realizing “roughly 25 percent unemployment—roughly the same as in 1931 or ’32.” He outlined an exercise in which he looked forward in time and compared the loss of jobs in June of this year to June 2021. Even if the U.S. added 25 million jobs in that 12-month timeframe, “we could still end up with 20 million unemployed, which would be worse than the financial crisis at its bottom,” he said.

He suggested that the country might borrow $14 trillion and lock in the rate, repaying it over 30 years. “It’s not staggering, given how inexpensive the world has made our debt.” Pushback comes from those who don’t want to burden future generations with such debt, but he said he wished he could have helped his grandparents during the Depression, “to avoid the misery and trauma. In 30 years, we’ll have more resources, not less. It’s not wise to pay for it all now. Look forward.”

Wong directed her next question to Susan Wachter. “We learned that fast policy response was important. What are your views on the policy side? What do we need to know?”

“This is unprecedented and not like the Great Depression,” said Wachter. “It’s far worse, and recovery in two-to-three years is optimistic. So far, the Federal government, particularly the Fed, has taken action in the right direction,” she said.

She predicted that the second leg of the crisis would be a demand-side response, which is already occurring as people lose their jobs as demand plummets. She believes the second quarter will drop by 30 percent, with fast recovery in the third quarter, and a small recovery occurring in the fourth quarter, for an overall down of 10 percent for the year. She believes 2021 will show similar results.

What changes? “The pandemic has to be under control, and we need monetary and fiscal policy that bring us out of this,” she said. “We need more [than the stimulus payments already made] to address state and local governments and small businesses. Mortgage rates are the lowest in history, which is good news, and we see 200 percent refi activity higher than last year, meaning people will have discretionary money in hand.”

The panel then discussed their views about various real estate sectors and the pandemic’s effect on them.

The office sector looks bad, and no one can predict what it will look like when people begin to return, according to Gyourko who noted that the sharing model isn’t working for now, for example. And maybe more space per employee will be the norm. “My fear is that we have less intense usage after the Covid crisis, when employers realize that employees can work from home,” he said, adding that student housing is another risky sector because no one yet knows if students will return to campuses in the fall.

Linneman felt that the industrial/warehouse sector, including in ports and around airports will suffer, unless the warehouses are storing items related to groceries. “Incomes everywhere are down,” he said. “Add nationalism and falling international trade, and it will be tough next year for warehouse.” He also predicted that “retail will come back slowly but dramatically; we’ll see really weak retail centers go out of business, but retail is part of our social being. People adjust, but that adjustment in retail will take one to two years.”

The panelists were then asked to look ahead and predict what participants should pay attention to. Wachter praised the “excellent, quick response,” which stopped the accelerating decline, but said that people may still be unemployed in three months when forbearance questions arise around delayed mortgage payments. “We have to come out of this during the summer, basically,” she said. “Then it won’t be a years’ long Great Depression.”

Linneman believes that individuals will begin to take control and adapt for their particular circumstances. “There is enough information out there. Peoples’ creativity is their saving grace.” And Gyourko believes that in three to five years, retail that survives the current crisis will be thriving.

Panel Two, “Smart Money & Unusual Economic Times — CIO’s Perspectives” was moderated by Asuka Nakahara, Associate Director, Zell/Lurie Real Estate Center at the Wharton School.

Panelists were Peter Ammon, Chief Investment Officer, the University of Pennsylvania; Gus Sauter, Former Chief Investment Officer, The Vanguard Group; and Jay Willoughby, Chief Investment Officer, TIFF Investment Management.

The men discussed the pandemic and its fallout as seen through their various philosophies. Peter Ammon described Penn’s approach as one that is focused on long-term returns in which volatility is seen as an opportunity rather than a risk. “We don’t know what the next crisis will look like, so we have to be able to manage the portfolio during times of stress, and we have an institutional framework and a belief that we have the right approach, which gives us a better place from which to navigate,” he said.The men discussed the pandemic and its fallout as seen through their various philosophies. Peter Ammon described Penn’s approach as one that is focused on long-term returns in which volatility is seen as an opportunity rather than a risk. “We don’t know what the next crisis will look like, so we have to be able to manage the portfolio during times of stress, and we have an institutional framework and a belief that we have the right approach, which gives us a better place from which to navigate,” he said.

Jay Willoughby, who represents dozens of foundations and boards agreed with Peter’s approach and added that the crisis has reaffirmed “the fact that you have to know what you’re doing and be committed to it … have a long-term view and stay within your framework. Have conviction in the way your portfolio is constructed.”

Gus Sauter agreed with both Ammon and Willoughby in noting that “the hard work is done up front. Be prepared for difficult times, and don’t overreact when it happens.” He added that he has rebalanced through market fluctuations but doesn’t recommend that anyone try to time the market.

Asuka Nakahara commented on the views stated by the first group of panelists. “There seems to be a disconnect between what the market says is going on and what the faculty says. Does that make sense to you, Gus?”

“Yes. All asset classes compete for capital. Bonds and stocks all want to attract investors, and stocks have been so volatile, they have to offer better returns going forward,” Sauter answered. “It might surprise people to know that stock market returns aren’t correlated to economic growth. Look at 2008-2009 … the economy has been growing slowly since then, and the market has been growing greatly.” Peter Ammon added that there has been a big disconnect since early March, reflecting smaller companies that are underperforming and a perception of economic risk. Jay Willoughby agreed with them and reminded the panel that there are more uncertainties because the economic crisis comes on top of a health crisis. The markets are just trying to “understand what’s going on,” he said. “The markets are doing what they always do.”

Nakahara led the discussion to private equity investments, wondering if cash is safe or risky. The men agreed that this is a good time to invest in private equity if that is your intention for raising cash. Sauter feels we have a similar opportunity now to that presented in 2010. He believes it’s appropriate for liquidity and as a portion of a fixed income portfolio. Willoughby added that cash plays a defensive role and can be used to take advantage of various opportunities if the world continues to be volatile, which he thinks it will. Ammon agreed that there are interesting opportunities when emerging from a crisis and cash provides investors with liquidity during times of market stress.

“The impact of what’s been happening over the past couple of months has been varied depending on sectors,” said Nakahara. “Pick one or two that you’ve looked at. What do you think short- and longer-term impacts will be on them from the pandemic and the reaction to it?”

Willoughby focused on housing and said, “The jury is out on every property type right now in my mind. And in office space, essentially every major corporation is saying, ‘You know, we don’t need as much.’ Having less demand with the same amount of new supply is tough.”

When the marketplace is more settled, most markets are efficient, Sauter began. But a crisis illuminates inefficiencies. Cruise lines, airlines, hotels … all were doing well prior and all went down, but are stabilizing, and will remain so unless there’s another shock, he added. “The interesting sectors are those with long-term secular trends. Energy is the most interesting to me because there is a secular undertone with alternative energy sources and supply,” he said.

He related real estate to energy, calling the pandemic a “catalyst” to increase the trend of people working remotely, and to increase the trend of consumers buying online.

The panel ended their presentation with a discussion of what the future will bring, specifically how everything will be in about three years. Sauter believes that things will be normalized, saying “this will largely be behind us.” Ammon hopes that society will be having substantive conversations about the inequities that have been brought into sharp relief. “We’ll be sorting through the economic pain in three years, and from an investment standpoint, there will be opportunities that emerge.” Willoughby believes that a cure will have been developed and most of the economic pain will be behind us. “When we come out the other side, we’ll see a bonding event, maybe even a global bonding event. Society will be in a better place to make progress and build.”

The third panel session, “The Science and Public Health of the COVID-19 Crisis: A Discussion with Penn Scientists,” was moderated by Todd Sinai, David B. Ford Professor, Professor of Real Estate and Business Economics and Public Policy; Chair, Real Estate Department. Panelists were Audrey R. Odom John, M.D., Ph.D., Chief of the Division of Pediatric Infectious Diseases, Children’s Hospital of Philadelphia, and Kevin Volpp, M.D., Ph.D., Founders President’s Distinguished Professor of Medicine, Medical Ethics and Health Policy, and Health Care Management, Perelman School of Medicine and the Wharton School; Director, Penn Center for Health Incentives and Behavioral Economics.

“As of today, there are 3.2 million confirmed cases of Covid-19 worldwide, 30,000 new cases are diagnosed in the United States every day, and we see 60,000 deaths,” said Todd Sinai. “What do you see as the main challenge of coronavirus over the next six to 12 months?”

Dr. Volpp said that the country is walking a tightrope, trying to maintain normal economic activity while minimizing mortality from the disease. “We’re under political and economic pressure to re-open the economy, but we’re not prepared to do that yet, and we’ll be struggling with this for some time.”

Dr. John, who works every day with patients with the disease agreed that the country (and the world) is facing many challenges, saying, “We’ve never seen anything like this … there are many ways this disease can present, and we need to ask fundamental questions to choose appropriate therapies. There are so many things we just don’t understand, but the next six months will shed a lot of light.”

Sinai wondered what the country can do to prepare to get back to some semblance of normal activity. Volpp offered three answers: a lot of testing, effective contact tracing, and ways to isolate those who are infected or are suspected of being infected. “We have a long way to go to meet the challenges posed by those elements,” he said.

The RNA testing currently being done with long swabs inserted up the nose is difficult and requires an “infrastructure of special tools and machines,” according to John. It’s also not that fast. Antibody testing has promise but doesn’t have the sensitivity and specificity required.

Effective contact tracing poses a challenge because so many are sick who are pre-symptomatic or asymptomatic and are circulating and spreading the disease without a clue. Privacy concerns preclude using cell phones to track people in the United States, even though it’s been effective in South Korea, Norway and Singapore, for example. “We have to figure out how to balance privacy rights with efficacy in tracing, and we need opt-in participation,” said Volpp. “Modeling suggests that if you can get to 60 percent participation, it’s helpful.”

Opening schools is also problematic because, although the kids would probably be fine, they can bring it home to their loved ones who are probably more at risk, said John. “We would have to incorporate some way of reducing transmission in schools … diagnostics? Screen kids weekly? Make them wear masks? Can you teach classes in shifts?”

Sinai mentioned the various tests that may work, including the saliva test. Both panelists agreed. “Even if we don’t have electronic contact tracing, what should we not allow as the country re-opens?” Volpp answered that he sees a “multiple peaks and valleys scenario, with economic and political pressure to re-open.” Moving too quickly could, obviously, cause more infections, requiring the country to clamp back down. “There will be challenges and it won’t be business as usual,” Volpp said.

Sinai then asked John about the possibility of a vaccine and of treatment. “Everyone is hoping for both and people are getting excited about clinical trials around the possibility of Remdesivir,” he said.

The data is not widely available, she replied, “but what we know looks promising … it shortens the course of the disease for those with severe cases, but probably is not for those without the severity because of the side effects … and it can be given only by IV. Within a year or two, we should see something that is a game-changer.”

She cautioned that a vaccine is tricky, and the depth of immunity is unknown. “Vaccine trials should proceed quickly, and we should know within a month or so what shows promise,” she said.

The group discussed what the fall and winter might look like, declining to give any real predictions. “It’s just too difficult to answer because no one knows,” said Volpp. “Prediction models show many different scenarios. Nothing has really changed from six weeks ago and there are no rosy predictions. We hope in the next four to eight weeks that we’ll have better testing, tracing and containment systems, but we’re nowhere near having that right now.”

John added that there will be a resurgence of cases and the country will be living with the pandemic for some time. “We have to be prepared to do the things that are necessary to tamp them back down,” she said. “We’re so interconnected on this planet that unless we change that, we’re all a risk to everybody.”

There are things that we all can do, and she recommended some: stay further away from one another; wear masks universally; and empower people to stay home when they are ill.

Sinai wrapped up the session by looking further into the future. “Three years from now we may still be in this coronavirus world … which will be hard for everyone’s psyche and economic well-being. It will affect how people interact. We don’t have a plan [in this country] to get control.”

John recommended that infrastructures be put into place as a result of this pandemic, because we will have new pandemics. “That’s how biology works and there is nothing to prevent a new pandemic flu from coming out next year,” she said. She is optimistic about the pace of research and the therapeutic options being developed. Volpp added that he is also optimistic that America will figure it out through scientific progress, American ingenuity and new arrangements around how we interact and work.

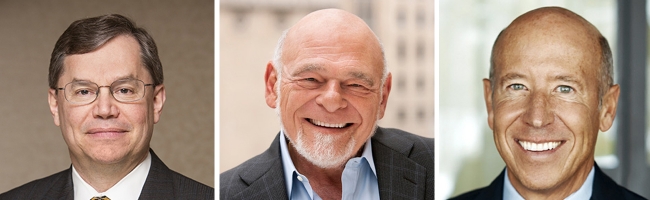

The final presentation of the day was A Conversation with Sam Zell, Chairman, Equity Group Investments, and Barry Sternlicht, Chairman & Chief Executive Officer, Starwood Capital Group moderated by Joe Gyourko.

“How are things developing now around the world?” asked Gyourko.

Sam Zell began the conversation by calling the world “frightening.” “There are no benchmarks now. We can’t compart this to anything else,” he said. “We need a period of great care and caution and go a month or two while monitoring. From my perspective, we won’t see a “V” recovery. Maybe a “U” is possible. That’s the best story I can come up with. Step by step progression seems to be the only way this thing gets solved.”

Gyourko wondered if this event may present “the opportunity of a lifetime.” And Zell replied that there may be many opportunities, but not yet.

Barry Sternlicht said he believes it’s important for leaders to be optimistic and that this may be better than originally thought. “There are zero interest rates all over the world, for example,” he said. “A medical solution will be found, and how we plot the course from here to there and what damage we do from now to then is the question.” He added that standardization and consistency in the way the pandemic is approached is key to creating consumer confidence again in travel, tourism, housing, and more. “What fundamental changes will we see and what will be different on the other side?” he asked.

The men agreed that the lockdown may do serious long-term damage to the U.S. economy, with Sternlicht asking about American incomes and unemployment. “We’ll be lucky if it (unemployment) goes back to 10 percent by the end of the year.” He talked about the challenges facing retail businesses and what the hotel industry might be like—hire fewer people, have lower break-even costs, remove room service, do very small meetings (maybe) and clean incessantly.

Zell added that he’s concerned about small businesses and noted that the information simply isn’t there. The men compared today’s crisis to the September 11, 2001, tragedy, which didn’t happen to the entire world at once, as the pandemic is.

Gyourko steered the discussion to the housing sector and commented that “one’s experience with Covid depends a lot on where you are.” Zell wondered how cautious people have become. “We’ve taken a huge chunk out of demand as a result of the virus and our response,” he said. “We’re looking for what’s going to restart that demand, and even when it gets restarted, at what kind of a pace will it grow?”

They agreed that there are consequences from a lockdown that may inspire another Great Depression. “There’s a cost that’s immeasurable,” said Sternlicht. They then discussed the changes that will happen in retailing—to direct-access—in restaurants, with fewer patrons allowed in at once and tables that are far apart; and with a loss of convention business.

Gyourko asked if there are other regulatory areas that pose risks that are worrisome, and will those affect investment perceptions.

Zell answered by paraphrasing a quote from George Santayana: “He who fails to learn from history is condemned to repeat it,” and then talked about the importance of paying attention to failed regulations of the past—using rent control as an example.

“I totally agree with Sam,” said Sternlicht. “You only need to visit Mumbai to see the effects of rent control. Beautiful buildings are disintegrating before your eyes because owners have no incentive to fix them up.”

Gyourko agreed and said, “My gut feeling is that this issue will be top of mind for investors who all agree there will be permanent change from Covid-19.”

The men then discussed the economy and the upcoming election with the results determining how the country will recover. “I put all my money on education and job training,” Sternlicht said.

Gyourko asked Zell how he will know when it’s time to jump back into the investment market, to which Zell replied, “I’ve never jumped out. I’ve just paused. If the pricing were right, I’d take advantage of any opportunity today, but it doesn’t exist right now … I don’t see any change in the value of assets or businesses … but when it does, I’ll act accordingly.”

The meeting was closed by Matthew Lustig who thanked all participants and their “input, insight and expertise” around the economy, the markets, science, and medicine.

Posted May 2020